maine excise tax exemption

Veteran Property Tax Exemption. Be it enacted by the People of the State of Maine as follows.

The products are subject to a 10 excise tax and the states 55 sales tax.

. Maines tax policy with other jurisdictions so Maine is not at a competitive disadvantage. Smith Tax Service Kountze Tx. For a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

A Veteran who served during a recognized war period and is 62 years or older. Each of these sales and excise taxes which are exempted appear to involve activities with a substantial presence within Maine and none of. LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

Maine offers property tax exemptions to wartime Veterans disabled Veterans Surviving Spouses minor Children and surviving parents. _____ Is a demonstrator of stock in trade dealers only. 434 20 is further amended to read.

Pay property taxes online. State law already waives this tax for veterans who are blind or who have lost the use of one or both legs. Or became 100 disabled while serving is.

2021 Tax commitment information. The Mission Restaurant San Diego. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Vehicles owned by this State or by political subdivisions of the State. Vehicle Registration Fee - 100 permanent and total service-connected disabled veterans exempt from one registration fee title fee and driver license renewal fee. Automobiles owned by veterans who are granted free registration of those vehicles by the Secretary of State under.

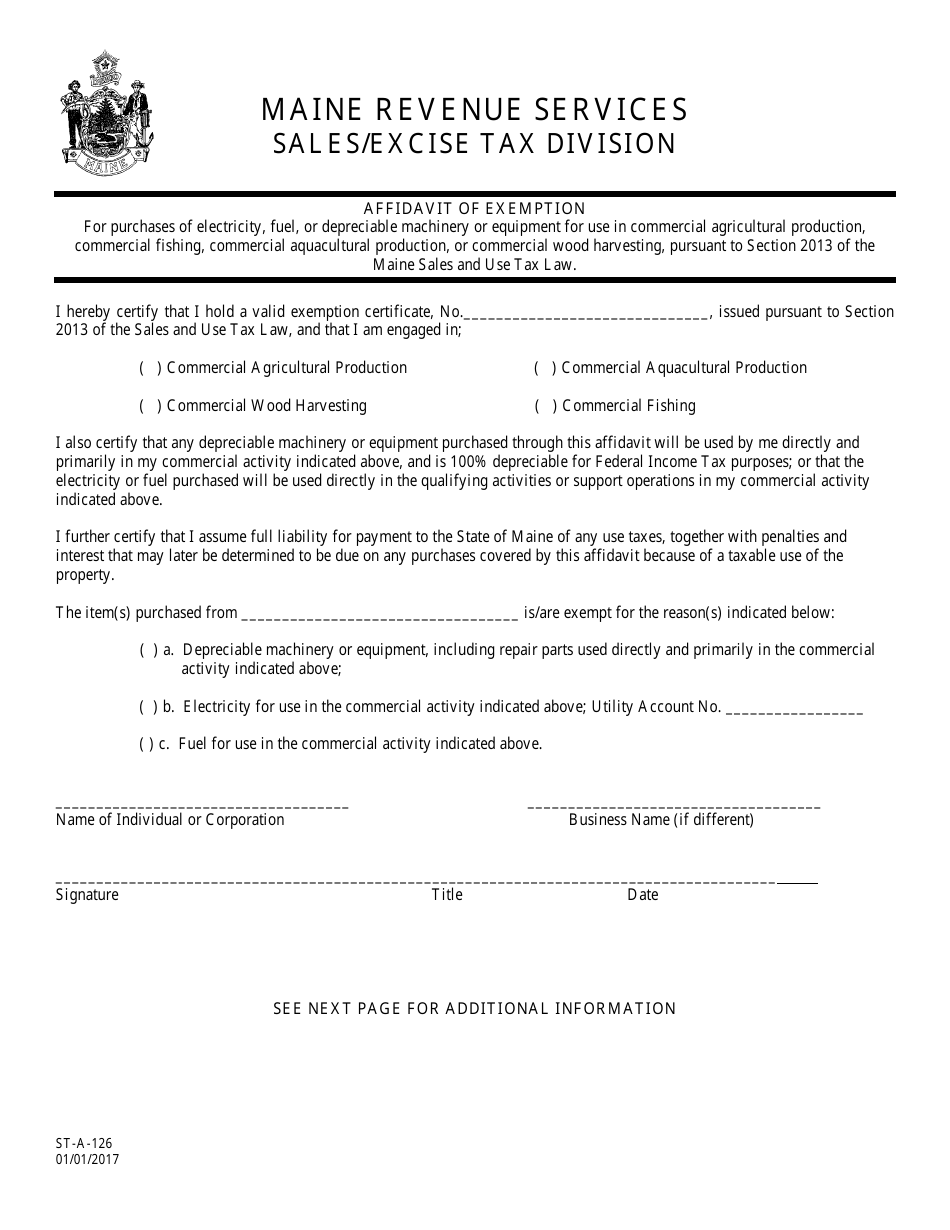

MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in commercial agricultural production commercial fishing commercial aquacultural production or commercial wood harvesting pursuant to Section 2013 of the Maine Sales and Use Tax Law. Excise Tax Calculator Kennebunk Maine. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle. 2021 Commitment by maplot. Maine Department of Inland Fisheries and Wildlife 353 Water Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-9037.

Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. 434 20 AMD 2. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

Excise tax is paid at the local town office where the owner of the vehicle resides. Alternate formats can be requested at 207 626-8475 or via email. Maine Revenue Services MRS is responsible for assessing the tax on qualified.

Maine approved recreational marijuana in 2016 allowing adults age 21 and older to possess up to 25 ounces of marijuana and it authorizes regulated cultivation and sales. Where do I pay the excise tax. WHERE DO I PAY THE EXCISE TAX.

El Palenque Mexican Restaurant Spring Tx. The excise tax due will be 61080. Board of Assessment Review Ordinance.

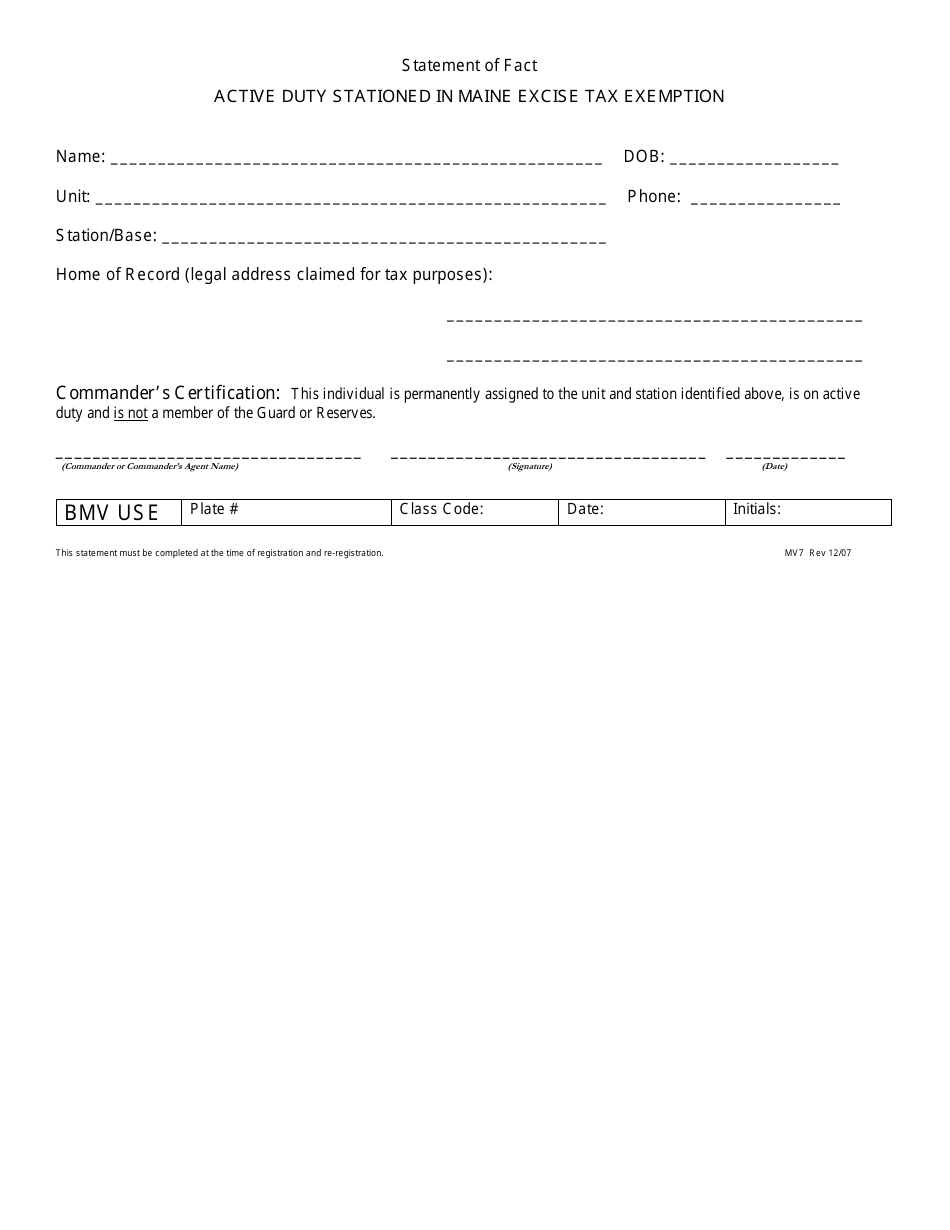

The following are exempt from the excise tax. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves. If you need financial counseling or other assistance please click on the map below to connect to all of Maines Legal and.

Supports suppliers distributors and traders dealing with indirect excise taxes. Military Exemption From Vehicle Excise Tax City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days. Vehicle Registration Exemptions and Financial Benefits.

To view PDF or Word documents you will need the free document readers. The excise tax rate is equal to the mill rate of the municipality where the equipment is located. Is a lifeboat or raft carried by another vessel.

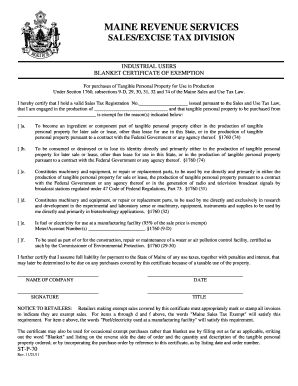

Jefferson Parish Property Tax Due Date. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION INDUSTRIAL USERS BLANKET CERTIFICATE OF EXEMPTION For purchases of Tangible Personal Property for Use in Production Under Sections 17609-D 29 30 31 32 and. Is a lifeboat or raft carried by another vessel.

18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500. The bill would provide a motor vehicle excise tax exemption for veterans who are receiving. 692021 - PASSED TO BE ENACTED.

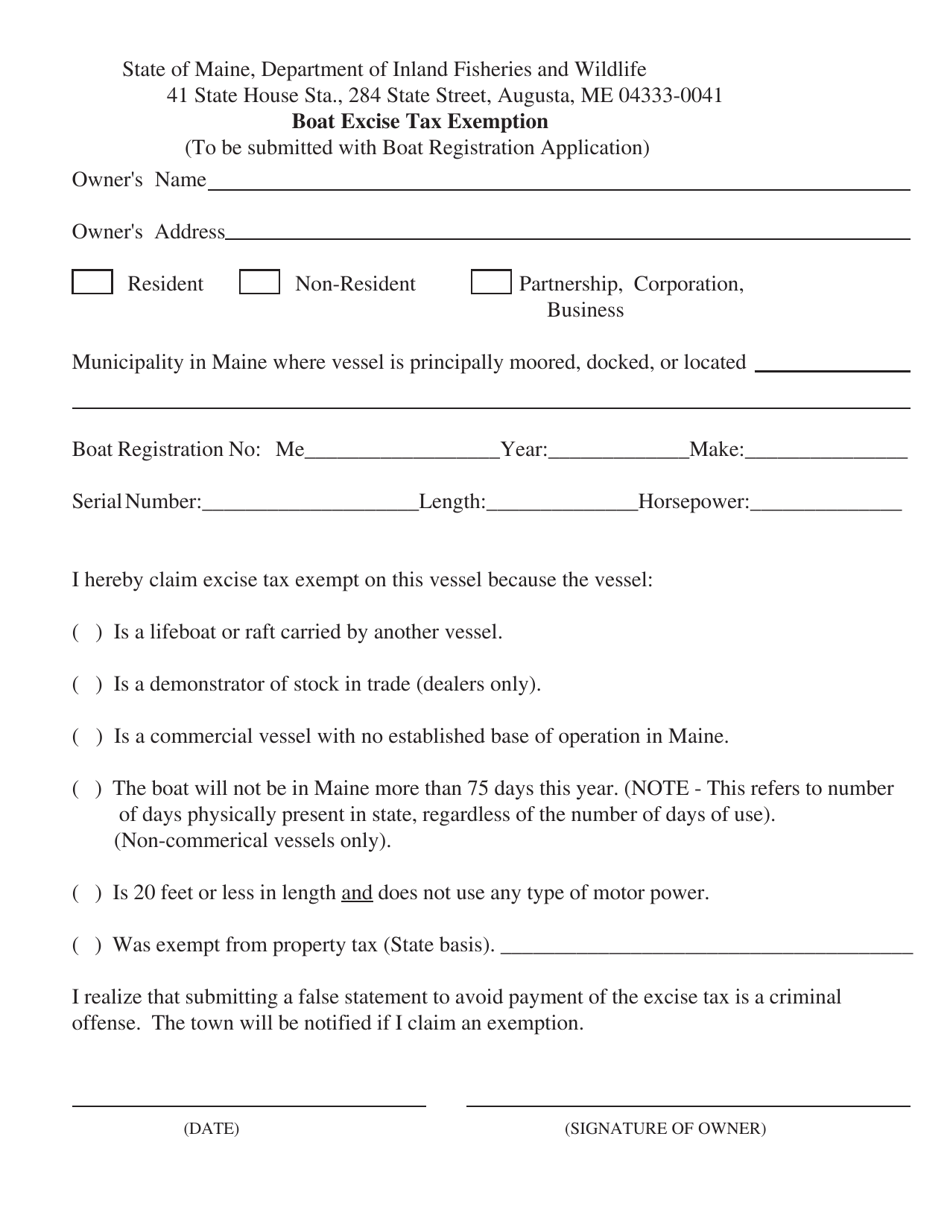

Publications and Exemption Applications. I hereby claim excise tax exempt on this vessel because the vessel. Excise tax is paid at the local town office.

_____ Is a commercial vessel with no established base of operation in Maine. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. I hereby claim excise tax exempt on this vessel because the vessel.

Or is receiving 100 disability from the VA. Sponsored by Representative Heidi Brooks. Tree Of Life Drawing Therapy.

Home of Record legal address claimed for tax purposes. Maine Veterans Property Tax Exemption. 36 MRSA 1483 sub-12 as amended by PL 2009 c.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Property Tax Maps and Information. 2020 - 2022 Tax Alerts.

04 Tax and interest 05 Filing and payment 06 Appeals 01 General Maine imposes an excise tax on all qualified telecommunications equipment located in the State. 2021 Commitment by name.

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Form St A 126 Download Printable Pdf Or Fill Online Affidavit Of Exemption Maine Templateroller

Fillable Online Maine Maine Revenue Services Sales Excise Tax Division Industrial Users Blanket Certificate Of Exemption For Purchases Of Tangible Personal Property For Use In Production Under Section 1760 Subsections 9d 29 30

Form Mv7 Download Fillable Pdf Or Fill Online Active Duty Stationed In Maine Excise Tax Exemption Maine Templateroller

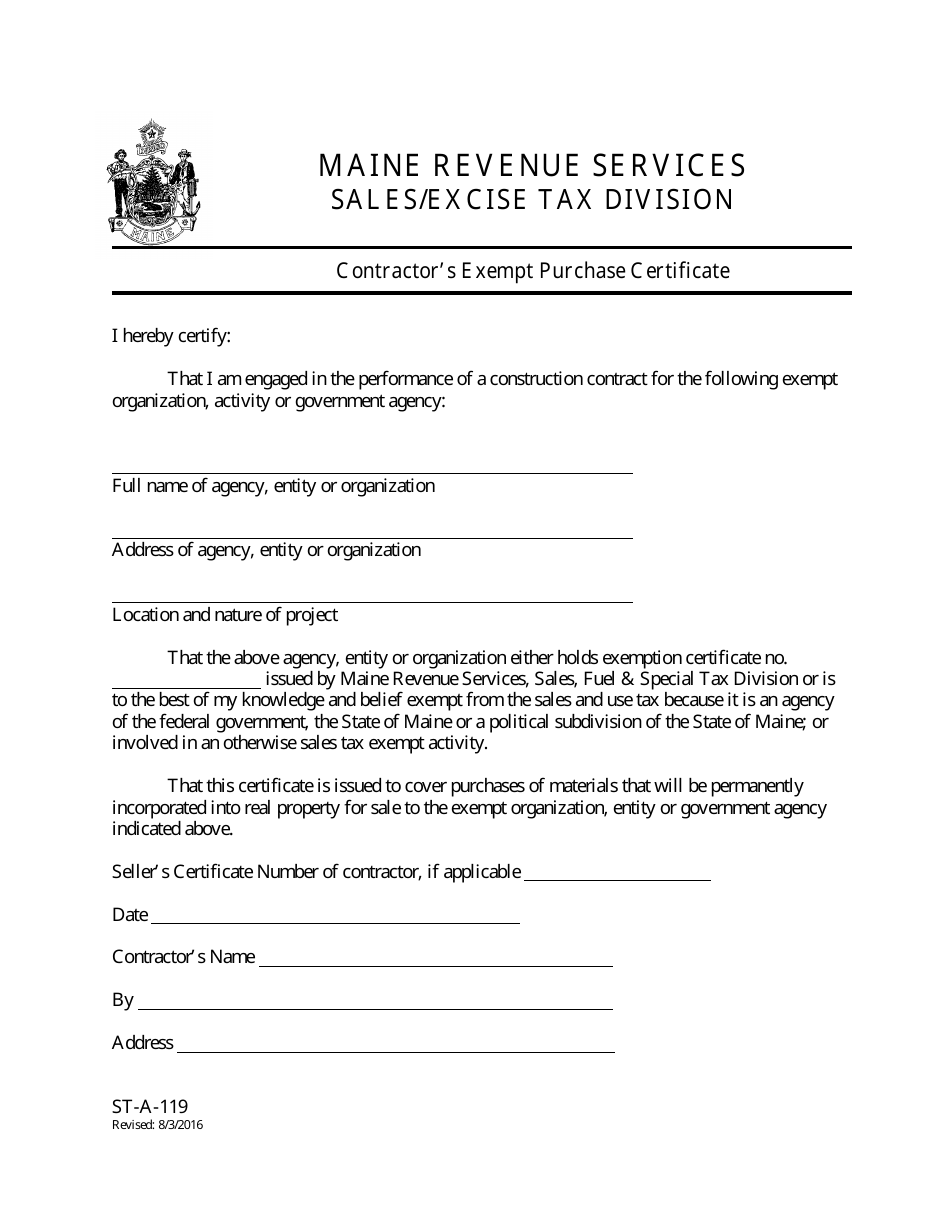

Form St A 119 Download Printable Pdf Or Fill Online Contractor S Exempt Purchase Certificate Maine Templateroller

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller